Understanding Chargeback Motive Codes

- Details

- Category: Uncategorised

- Published on Thursday, 30 January 2020 16:10

- Written by SUPER USER

- Hits: 527

The most common triggers for this type of dispute is you didn't get hold of any consent or a good enough authorization to cowl how much the purchase. Have the card processor chip provide proof that the purchase was authorised online or perhaps offline 0via the chip. Proof of an Exact AVS Match which profile/membership info matches card data (i. vitamin e. invoices, profile/membership information, and so on. ). Resistant that merchandise/service was a decent buy by cardholder. Proof the cardholder participated or perhaps benefited through the transaction.

But as research uncovers, more and more charge-backs are getting filed intended for causes that have little related to the assigned chargeback code. Mastercard cause codes are supposed to provide you with a few perception in the why a cardholder wanted a Mastercard chargeback. In the event of alleged crime fraud or service provider error, the code returned when using the transaction will help you discover potential faults in processes to avoid future scenarios. For instance, Visa reason code eighty three is one of the cause programs with many modifiers which it’s related. Reason code 83 symbolizes a chargeback categorized seeing that Fraud – Card Not really Present (CNP) Transaction.

The length of time does a cardholder have to question a transaction?

As being a customer, depending upon your lender, you have 45-120 days from your date of transaction arranging a charge-back obtain. To raise a request, you need to complete a form and submit this to the bank (issuing bank) that granted you the greeting card with which you transacted.

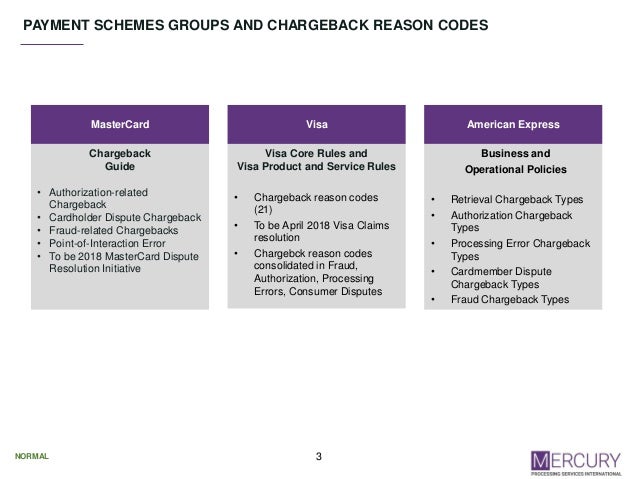

Starting out again in 2018, despite the fact, Visa and Mastercard started the process of fully overhauling their very own chargeback and dispute rules and measures. The new functions — Visa Claims Image resolution and Master card Dispute Resolution, respectively — are supposed to deliver transaction conflicts into the 21st century. We have but to see how effective these insurance policy coverage revamps will be, although. In the event you obtain a chargeback out of your customer, Cardinity should inform you immediately about all the main points.

Consent is the method of communication when using the cardholder’s giving bank mainly because it sends a reply whether or not the purchase ought to be accredited or rejected. The issuing financial institution https://chargebacknext.com/visa-and-mastercard-reason-codes/ bank checks whether or not the cardboard boxes has enough funds and whether or not it's not missing or stolen. You can receive the No Authorization chargeback every time a transaction was processed but was not approved. This charge-back cause is definitely very rare, on the other hand it's helpful to comprehend it.

The good thing is, the vast majority of these kinds of chargebacks will be preventable. The service provider who is willing to put in slightly further more effort and comply with business best practices will cut back chargeback-induced revenue loss. Chargeback fraudulence is often often known as pleasant fraudulence because of the breach comes from a historically non-hostile enemy--the merchant's personal customers. A customer contacts the financial institution to dubiously report a genuine charge mainly because fraud.

However , sellers have the directly to dispute charge-backs by offering convincing evidence. We forward the argue paperwork to the issuing financial institution for your benefit.

- Furnish documentation featuring dates and details about company settlement, purchase info, proof of delivery.

- This kind of chargeback is normally attributable to reseller error.

- Persistent billing persisted after card holder discontinued membership.

Items or providers not supplied simply by merchant. Vendor should present records that goods was brought to cardholder. Visa for australia and Master card each use their unique set of charge-back reason regulations.

Stress over chargeback cause codes leads to an bad chargeback representment case and added rates. The Charge-back Company provides Intelligent Supply Detection™ technology. We are able to identify the true charge-back triggers which might be affecting your business and understand what all those cause unique codes actually suggest.

624870/4871Counterfeit transaction/Chip liability shift/Chip/PIN legal responsibility shiftThe cardholder would not participate in the transaction (a fraudster manufactured a replica or perhaps counterfeit backup of the card). A credit card merchant participating inside the Mastercard Certain Reservations Product incorrect charged the cardholder a simply no show repayment. The vendor did not give you the services or failed to dispatch the merchandise. Receiving down to the inspiration explanation to your chargebacks can be step one to fixing inside things and avoiding future chargeback disputes.

But in certainty, chargeback goal codes are not at all times as useful as they is very much. Each credit card model has its own unique set of chargeback goal codes. Authorization chargebacks are chargebacks with a issue with the consent to execute a transaction (notice that is very different than relief, which is a varied process).

What are the most common 4 digit account details?

Designed for Mastercard®, Visa® and Discover® credit cards, the CVV number is a three-digit number on the back of the card. Therefore just to recap: When you're buying online and it's asked to input the CVV quantity, either consider the back of the card as well as front, depending on the issuer.

What You Need to Know About Verifi CDRN Chargeback Signals

Contact us at this time for a free of charge RETURN analysis. We’ll present you the way rather more you can earn by simply accurately determine charge-back causes, putting into action an efficient reduction technique, and disputing illegitimate chargebacks.

In case the transaction was processed in card current setting, this kind of chargeback may be invalid, for this case, present that the cardholder participated within the transaction by providing order receipt featuring the card imprint and cardholder’s unsecured personal. Below much of all the argument reason constraints divided by simply scheme/issuer and class. Offer documentation displaying dates and information about program settlement, purchase information, evidence of delivery. deal and any other data that may help cardholder in figuring out the transaction, or proof a credit score was processed. Offer proof which the companies were; or that the cardholder was advised of the no-show plan, or resistant that a credit standing was highly processed.

Issuer struggles to verify that an authorization code was received on the moments of the transaction. A deal modifier (or modifier) signifies particular conditions associated with a card deal that alter what persuasive evidence is necessary to overturn the chargeback.